Ask someone to describe their favorite wild cat and they’ll usually use words like, “strong”, “agile”, “elusive”, and “graceful”. Wild cats are renowned for their ability to stalk silently over leaf-strewn jungle floors, snow-covered cliffs, treetop branches, and shifting sands.

In their natural habitats, wild cats rely on their physical strength and flexibility to become stealthy and successful hunters. Life in captivity, however, can present unique health challenges that are rare or altogether absent in the wild. One significant concern is Metabolic Bone Disease (MBD), a condition that compromises an animal’s bone health and overall well-being. For a cat, this means losing the ability to move with their distinctive feline grace, condemning them instead to a life of broken bones, debilitating arthritis, and excruciating pain.

What is Metabolic Bone Disease and why is it so common in captive wild cats?

Metabolic Bone Disease is an umbrella term for a range of disorders that weaken bones due to imbalances in calcium, phosphorus, and vitamin D. In wild cats, this can lead to brittle bones, deformities, and an increased risk of fractures. MBD is most commonly seen in young, growing animals, but it can also affect adults if their diet and environment do not meet their specific needs.

In captive wild cats, MBD is nearly always a direct result of improper care. Wild cats, especially big cats, are expensive to feed properly. As a result, wild cats exhibited in roadside zoos, where profit is valued over animal welfare, are often fed inexpensive ground meat which is far from a complete and balanced diet. Usually, no supplementation is provided, leaving the animals to suffer from a myriad of vitamin and mineral deficiencies, including calcium.

We regularly encounter MBD in the wild cats that are surrendered by or rescued from private owners who were unable to meet their cat’s complex needs. Whether due to ignorance or outright neglect, the cat is the one who pays the price, and payment can last a lifetime. This is one of many reasons that WildCat Ridge does not support the exhibition or private ownership of wild cats.

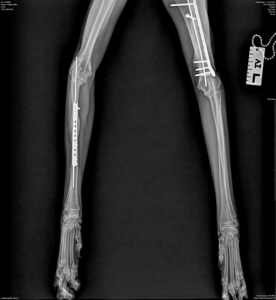

Serval Misha’s forelimbs after having pins placed due to multiple fractures stemming from Metabolic Bone Disease

Causes of MBD in captive wild cats

- Nutritional deficiencies and improper diet:

- Calcium imbalance: A diet lacking adequate calcium or containing excessive phosphorus disrupts bone mineralization. Feeding a cat a diet consisting of predominately boneless or ground meat can cause a deficiency in calcium which leads to the thinning of bones as calcium is leached out to maintain proper blood calcium levels.

- Vitamin D deficiency: Vitamin D is essential for calcium absorption. Cats kept in indoor enclosures with limited sun exposure or cats fed unbalanced diets may not produce enough vitamin D.

- Lack of physical activity:

- Insufficient exercise in captivity weakens bones and muscles, increasing the risk of MBD.

Symptoms of MBD

Early detection of MBD is crucial. Symptoms to watch for include:

- Difficulty walking or reluctance to move

- Lameness or stiffness

- Swollen joints or limbs

- Bone deformities

- Pain or sensitivity when touched

- Fractures that occur with minimal trauma

Prevention strategies

In order to prevent MBD in our wild cats at WildCat Ridge Sanctuary, we feed a balanced diet specific to each of our residents. We provide diets that closely mimic the nutritional profile of prey in the wild, including calcium-rich components like bones.

All of our cats have enclosed outdoor areas giving them access to natural sunlight in addition to dietary supplementation with Vitamin D to ensure proper calcium absorption.

Enrichment is an integral part of keeping captive wild cats happy and healthy. We encourage natural behaviors like climbing, pouncing, and running to promote bone strength.

Prevention is key for many health concerns including MBD and our cats undergo regular health monitoring and routine veterinary check-ups.

MBD at WildCat Ridge Sanctuary

Serval Cricket lost a front leg from the ravages of Metabolic Bone Disease

Metabolic Bone Disease is a preventable and manageable condition that highlights the importance of providing wild cats with optimal care in captivity. By prioritizing proper nutrition, environmental enrichment, and regular health assessments, we can help these incredible animals thrive, even outside their natural habitats. At our sanctuary, we are committed to the holistic well-being of every resident.

Sadly, we have rescued many cats over the years that have suffered from MBD. This illustrates just how important intake exams and exemplary veterinary care are for our sanctuary cats. Current residents who came to us with MBD include tiger brothers Calvin and Hobbes, both of whom are showing significant signs of early onset arthritis. Kane, Cricket, and Misha, are all servals who also presented with MBD upon intake. Make sure to check out each of their compelling rescue stories!

To learn more about our sanctuary’s work, explore our resources or follow us on TikTok, Instagram, or Facebook. Together, we can continue to give these amazing cats the lives they deserve.

Recent Posts

-

January 25, 2025

-

December 28, 2024

-

December 22, 2024

-

October 16, 2024

-

October 8, 2024

Tags

Archives

- January 2025

- December 2024

- October 2024

- July 2023

- March 2023

- February 2023

- June 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- November 2020

- August 2020

- July 2020

- June 2020

- May 2020

- March 2020

- February 2020

- November 2019

- September 2019

- May 2019

- April 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- October 2017